Managing payments for a business can feel overwhelming, especially if you’re juggling invoices, bills, and tight deadlines. That’s where Melio Payments comes in.

It’s designed to make paying vendors, contractors, or other business expenses simple and stress-free.

Whether you’re a small business owner or just starting out, Melio helps you keep track of payments and stay organized—all without any complicated tools.

In this review, I’ll share everything you need to know about Melio, including its features, pros, cons, and how it works. If you’re wondering whether it’s the right fit for your business, you’re in the right place. Let’s dive in!

Melio Reviews 2025: An Overview

Oh, Melio Payments! They’re like the fairy godmother of invoice payments, making it all so simple and hassle-free. And the best part? They put the power back in your hands so you can pay your way and keep your cash flow happy.

No more bending over backward for your vendors or suppliers – it’s time to take control!

It’s amazing how Melio makes managing your payments so easy. You can use the Melio dashboard to send payments to your suppliers and vendors via bank transfer.

Melio raises $110M on a $1.3B valuation to bring B2B payments for SMBs into the 21st century. Credits: Techcrunch

Integration Of QuickBooks With Melio

Well, here’s some excellent news for all QuickBooks users. Melio is now linked to QuickBooks, and all of their mutual clients can now benefit from the sync.

All of your bookkeeping and payments will be handled in one location. In fact, you may use the same QuickBooks credentials to log in to Melio.

Melio.me: Services

Melio.me is the quickest online payment acceptance and tracking service. Your clients do not need to register with Melio and create an account to make a payment to you.

Users can also make a payment using a bank transfer, which occurs without deduction or with a credit card.

Melio: Create an Affiliate Program

This is a fantastic usage for all Melio users who are also affiliated with an affiliate network.

It is extremely simple to establish and distribute your exclusive and unique link to all of your buyers and interested clients with the help of Melio.

Melio tracks and compiles a list of all your potential clients using approved cookies. You will get access to a potential client database for at least ninety days.

You’ll also receive a $200 referral fee every time a new customer makes their first transaction with Melio.

You will be able to view these references at the conclusion of each month, after which you can credit the amount to your bank account via sites such as Stripe or PayPal. This full procedure takes 10-15 days.

Melio: Ease Of Use

The support that Melio offers to its customers is off the charts. With all its plans, you shall be provided with round-the-clock live support. In fact, you will even be able to gain services from a dedicated accountant to address all your doubts.

You can also reach out to Melio by mail or email on all of their social media pages.

What Are the Key Benefits Of Melio?

- The first thought that came to our mind while thinking of Melio is that most of its services are free, and there are no signup or registration charges that the users need to pay. All of the bank transfers made are completely free; that is, the ACH payments are free. A small transfer fee is applicable for the other transactions, which is as low as two point nine percent.

- Next is the ability to pay through Melio with the help of your credit card.

- Third is the integration with QuickBooks, which allows you to sync your accounting and payments in one place. This eliminates the need to maintain separate data lists.

- Next, you can have unlimited users and receive payments without limits. You can even add separate dashboards for your clients.

How Does Melio Work?

To step up an ACH with Melio is pretty simple. There are a few steps that you need to follow.

- Open Melio and your bill in it. It will automatically get synced.

- Next, please switch to the Melio Dashboard and open it.

- Go to the bill’s section and click on your bill.

- Then, all you need to do is schedule your bill payments and select the bank account from which you wish to schedule them.

All that remains is for your seller to accept your bill as part of the ACH invite.

Melio Business Features:

- Melio allows you to send checks free of charge, as well as Free bank transfers (ACH) and bank deposits.

- The Business account allows unlimited users per account, which is convenient for using and syncing processes with QuickBooks Online.

- It is also easy to schedule payments, and payment tracking is easy.

- The software allows live support options for easy clearance if there are any hindrances or complaints.

- All payments through cards charge a fee of 2.9%, which also applies to payments received.

- The software supports unlimited companies, clients, AP, and AR management.

Melio Accountant Features:

- This feature requires no sign-up or subscription fees and is also free to send checks. However, like a business account, this also charges a fee of 2.9% for sending and receiving credit card payments.

- Bank transfers charge no fees. Melio offers free check sending, free money transfers (ACH), and free bank deposits.

- The Accountant’s account allows for an infinite number of users per account, making it easier to use and synchronizing the processes with QuickBooks Online.

- Aside from that, scheduling payments is easy, and payment monitoring is simple.

- This also includes features like dedicated live support for help and FAQs with quick and easy updates of all the preferred payment methods and processes.

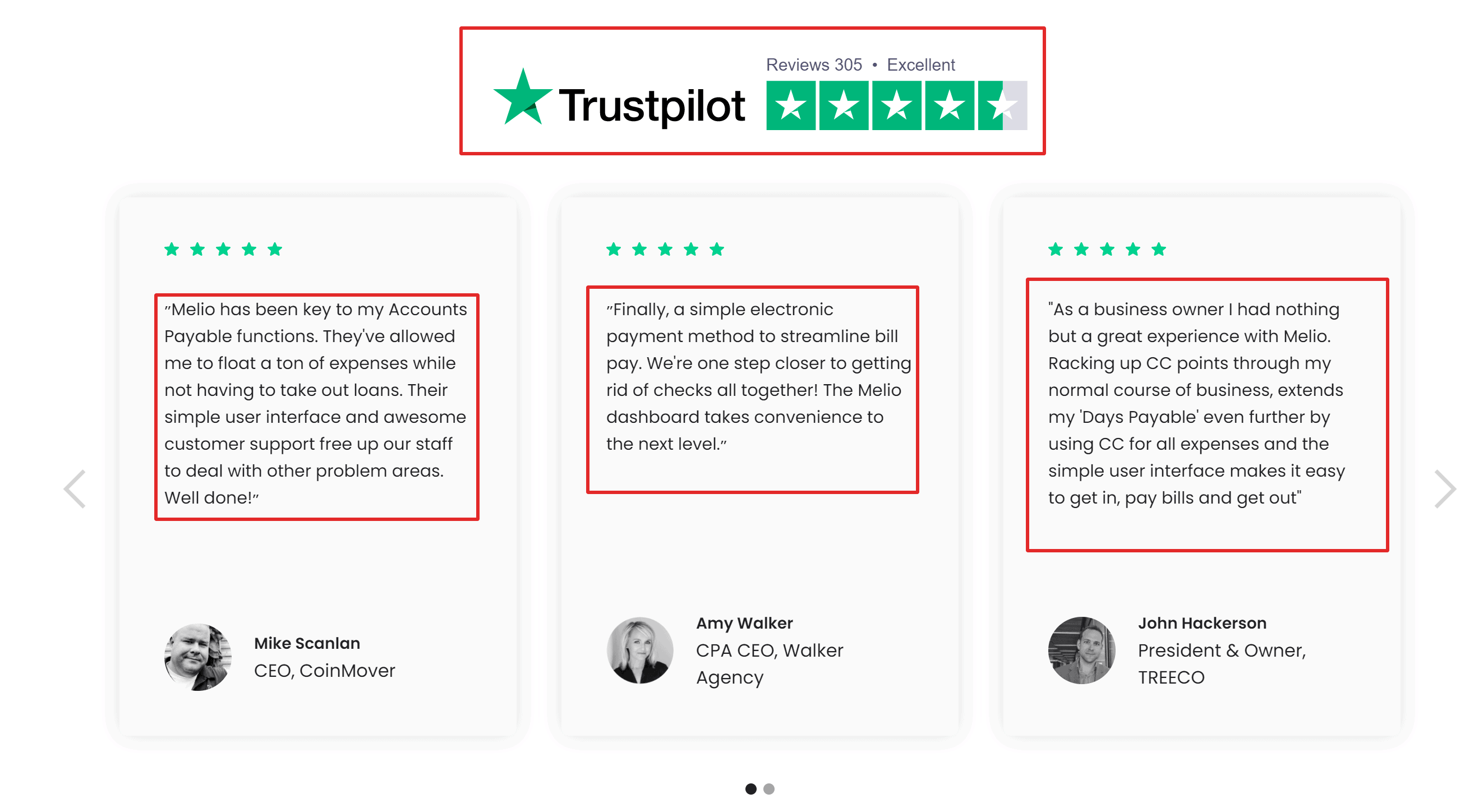

Melio Customer Reviews & Testimonials

“Melio has been a great solution. It has been very easy to train my clients how to use Melio. With the recent development of the accountant’s portal, I can manage all my clients in one spot. I anxiously await any & all new updates!”

Stephanie Mack

Account Mobility

״Finally, a simple electronic payment method to streamline bill pay. We’re one step closer to getting rid of checks all together! The Melio dashboard takes convenience to the next level.״

Amy Walker

CPA CEO, Walker Agency

“One of the challenges of being a small business owner is keeping our expenses low and still being able to provide high-quality service. Melio helps me speed up the process of payment delivery and offers the possibility of using a credit card, to have more cash flow for the company. ”

Stanislav Nikolov

Founder and CEO of SPN EVENTS

FAQs

👉 How do I verify my business with Melio?

After the first payment, you will be asked to enter your organization’s legal information. Like business name, address, Tax ID type, and number. Sole proprietors can enter their home address as a business address.

✔ Do I have to notify all of my vendors that I’m using Melio?

When submitting payments with Melio, you do not need to contact any of your vendors. Melio does not require vendors to register in order to be aware of pending fees or to collect funds.

🔥 What will my vendors see when I use Melio?

Melio never gives out the bank account information since the check is paid into Melio's account. Your seller can send you an email confirming that the invoice has been sent.

💥 Can Melio schedule my vendor payments in advance?

Yes, really. Melio's top priority is keeping you on board with suppliers and assisting you with cash flow management.

👓Does Melio support international payments?

Melio currently only accepts transfers between businesses in the United States. Payments from outside the United States are not approved, and only credit cards issued in the United States are accepted.

🙄 Is it possible to pay Mortgage with Melio?

Yes, you can pay a mortgage with Melio, for your business with a Mastercard or Discover. Currently, American and Visa cards are not acceptable.

✅ Where is the headquarters of Melio?

The headquarters of Melio is in New York.

😍 Is Melio a part of QBO?

No, Melio is not a part of QBO. You can use Melio, even if you aren’t using QBO. However, if you are using QBO, you shall benefit while using Melio

➡️ Is Xero in sync with Melio?

No, Xero is not in sync with Melio.

😅 Is it possible to pay with any credit card?

Melio presently accepts the following credit cards: American Express, Visa, Mastercard, and Diners Club. Melio will mail a check or make a bank transfer to your vendor on your behalf if you pay with a credit card. Please send an email to [email protected] if you'd like to pay with a different credit card provider.

💰 Do I have to let my vendors know that I'm using Melio?

No, you don't. Melio either mails checks on your behalf or transfers funds to your vendor's bank account (regardless of how you choose to pay). Vendors are not required to register in order to receive funds; instead, they will get a check or a deposit into their bank account (depending on your preference).

👍🏻 Is it possible to make payments in advance of the bill's due date?

Yes, you have the option of picking a future date for your payment transaction when paying your bill. Melio allows you to arrange payments in advance, eliminating the need for reminders to pay on time.

Quick Links:

- Payoneer Review

- Payoneer Vs Paypal

- Wise Vs Payoneer

- Capitalist.net Review

- WP Simple Pay Review

- NetSuite Review

Conclusion: Melio Payments Review 2025

Melio has truly transformed the way I navigate the complex world of money management!

I now feel a renewed sense of control with every transaction, allowing me to set the terms of my payments. I’m no longer constrained by rigid payment structures or influenced by the whims of others.

With Melio, I can manage my cash flow with elegance and efficiency. Its adaptability is delightful! Imagine a world where the ever-changing landscape of payment methods no longer frustrates us.

With Melio by our side, we can easily adjust to varying payment amounts and schedules.

Melio also provides unlimited monitoring and user access, a feature that even the most expensive accounts payable software can’t match. There’s no need to sign a contract or pay for shipping. Additionally, Melio takes care of tax documentation and offers live support.

However, it’s worth noting that Melio does have some drawbacks. It lacks vendor management and automated OCR data entry, which could be significant issues for larger enterprises.

Overall, I would highly recommend trying Melio Payments.

Don’t forget to share this awesome post on social media. Join Bytegain on Facebook, Linkedin & Twitter.