The fundamental tenet of financial management is that the majority of people have many service providers managing their bank accounts. This initially sounds and appears to be okay, but as time goes on and your funds continue to grow, it may become more difficult to understand how they all fit together as a whole.

Consequently, by combining their data and records from many service providers on a single platform, servicing them can be made simpler. You will find it much simpler to efficiently arrange your finances as a result, including growing your investment portfolio and reducing your debt obligations.

What is PocketSmith?

Because PocketSmith is entirely cloud-based and doesn’t need any specialized software to be installed, it may be utilized from any location. The server has a wide range of import options, and it can take bank feeds from 36 different nations.

The service is quite similar to Mint.com, with the exception that whereas Mint is free, PocketSmith requires a monthly subscription charge (although there is also a feature-restricted free version).

Who is PocketSmith for?

It is for those who want to maintain their financial stability!

A mobile app called PocketSmith was created to make it easier for you to manage your money at all times. It’s ideal for people who want more consistency in their financial lives, and being able to log onto this platform will provide them access to both current transactions and email updates that can notify users about impending decisions that may have an impact on their spending habits in the future.

Someone with a lot of financial obligations and duties is the ideal user for this program.

They might be the owner/operator of an active business, have three retirement accounts, fourteen non-retirement investing accounts (like student loans), two rental properties, and more, but they still need to have access to information about all of these sources so that money doesn’t run out when you least expect it.

By providing advice on how much should be coming in each month going forward based on historical data sets, PocketSmith’s forecasting feature will help them avoid crunches.

PocketSmith Pricing Plans

Customers of PocketSmith have a choice between three distinct packages. Each of these packages has a different pricing point and offers a special service.

Signup Pocketsmith for Free

It all begins with a PocketSmith subscription, whether you want to know how much money you spend on groceries each week or how much money you’ll have in your bank account in three months.

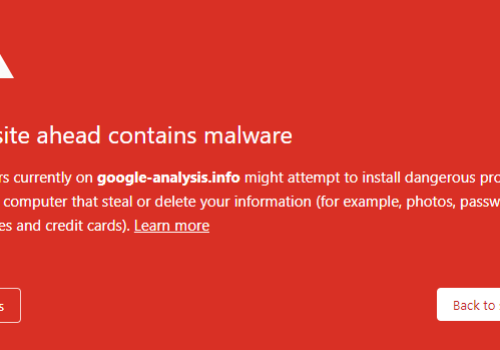

PocketSmith is an extremely secure internet software that you can access from anywhere and use in your web browser.

They are committed to preserving your privacy and security. We don’t display advertising to you, and they don’t sell your information. Right in the midst of the Global Financial Crisis, we were established in 2008. They are aware of the necessity to take charge.

It’s simple and takes only a minute to sign up. Please click the icon below to register. Return here and begin with the forecasting instructions after that.

They generate revenue via their Super and Premium subscriptions, which provide capabilities for users who wish to dive deeper. Details about them are provided below.

They have produced tips on their website that will assist you to get the most out of their free subscription.

Since it is yours to keep forever, please utilize it to begin taking charge of your finances. You can always decide to upgrade later if you want to support them or if you’re prepared to plan ahead even further.

Quick Links:

- Best PocketSmith Alternatives

- PocketSmith Coupon Code

- Rich Dad Poor Dad Review

- Start A Finance WordPress Blog

- PocketSmith Coupon Code

Wrapping up

When it comes to money, PocketSmith can mean the difference between success and failure. Although that’s the only choice left, if you’re having trouble paying your bills, it might not be worth it in the long run if there are short-term compromises required.